The rest is made up of estate taxes excise. Please determine if it This problem has been solved.

Taxes Tariffs And Fees How Government Raises Money Center Forward

Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined.

. Income consumption and wealth. Heres where it came from. According to a 2005 report from the US.

This is partially because more than half of business income in the United States is reported on individual tax returns. When the federal income tax was implemented to help finance World War I in 1913 for example the marginal tax rate was 1 on income of 0 to 20000 2 on income of 20000 to 50000 3 on. The Federal Government taxes income as its main source of revenue.

2 Raising taxes slows long-term economic growth. If the United States government raises the income taxes on the wealthiest Americans while increasing welfare payments to the poorest Americans the result will likely be increasedecrease in efficiency and increasedecrease in equality in the United States. Suppose you live in a state with a regressive sales tax system.

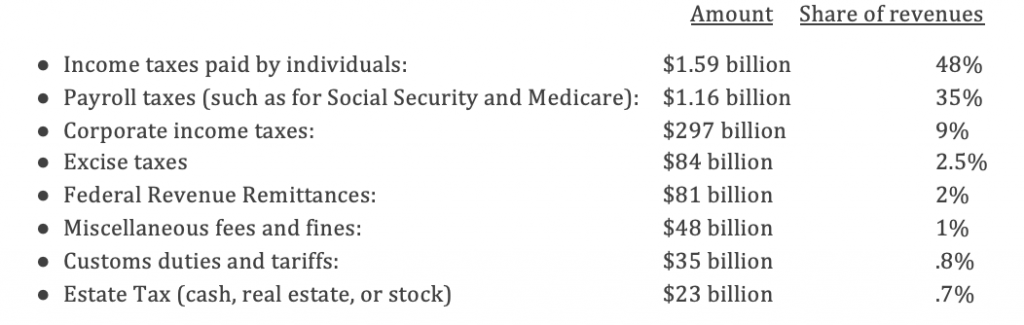

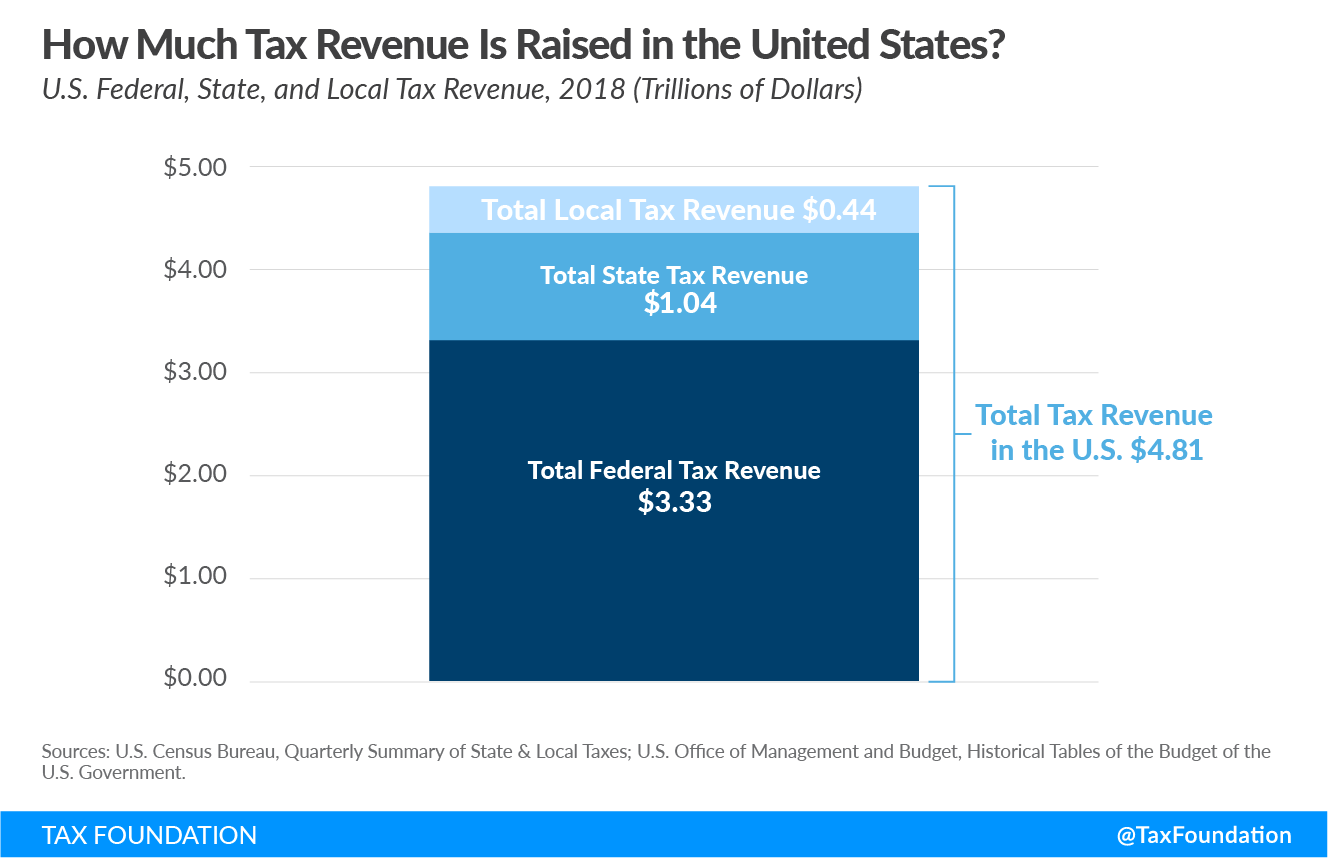

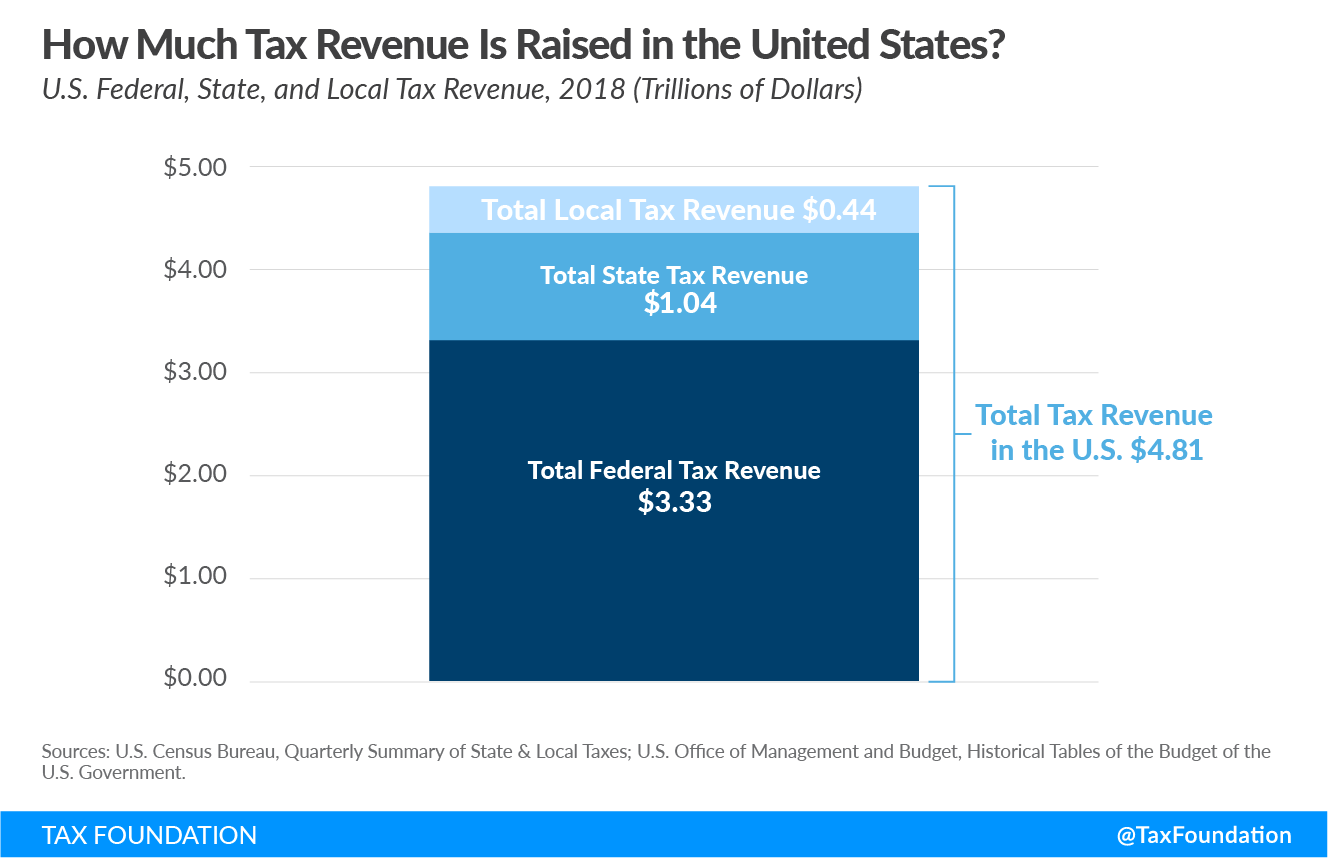

While OECD countries on average raised 24 percent of total tax revenue from individual income taxes the share in the United States was 415 percent a difference of 175 percentage points. In fiscal 2017 the government raised 33 trillion. President of the United States and United State Congress.

Economic growth is measured by the growth rate of. Definition When economic benefits are distributed uniformly across society When a society gets the most it can from its scarce resources Efficiency Equality All societies face a trade-off between equality and efficiency if the United States government raises the income taxes on the wealthiest Americans while increasing welfare payments to the poorest Americans the result will likely. You earn 20000.

Lets take a look at this past year for instance. Federal tax revenue comprises the total tax receipts received by the federal government each year. Tax efficiency will increase.

What type of tax system does the United States government use to collect income taxes. A states sale tax is 8. Even then individual income taxes didnt become the biggest source of federal revenues until about 1944.

Label it United States. Most of it is paid either through income taxes or payroll taxes. Which type of tax system has the same rate for all income levels.

If the United States Government were to replace the income tax with a consumption tax compliance costs would inevitably diminish. Advertisement Advertisement New questions in Mathematics. In 2016 alone it is estimated that tax compliance cost the US.

Learn about our Financial Review Board. Government was capable of paying for its expenses without an income tax prior to 1913 largely because it had fewer responsibilities. The cost of preparing and filing all business and personal tax returns is estimated to be 100 to 150 billion each year.

In the United States the average persons life expectancy was roughly 78 years old in 2010 but only. This places a higher burden on low income individuals. Raise income taxes raise Social Security taxes cut Social Security benefits and.

Draw a point on the curve that shows the approximate location of the United States on the curve. As a percentage of GDP total government receipts in the United States are _____ those of most other industrialized countries. The effect on economic growth if the government raises taxes.

The government raises autonomous taxes and government expenditure by 100 million each. Federal income tax rate paid by American corporations in 2018 was 78 percent. Government approximately 409 billion dollars.

The slower the economy moves the higher the unemployment rate the less competitive the business environment becomes and the more people suffer across the board. Their worldwide effective income tax rate which includes taxes paid to the United States and to other countries was 88 percent. A permanent income tax was not enacted until 1913 when the 16th Amendment was ratified.

If the United States government raises the income taxes on the wealthiest Americans while increasing welfare payments to the poorest Americans the result will likely be a _____ in efficiency and an _____ in equality in the United States. People respond to economic incentives. When tax rates increase as peoples income rises so that people who earn more pay a higher proportion of their income in taxes it is a _____.

See the answer PART A. Government Accountability Office the efficiency cost of the tax systemthe output that is lost over and above the tax itselfis between 240 billion and 600 billion per year. In fiscal year FY 2021 income taxes will account for 50 payroll taxes make up 36 and corporate taxes supply 7.

If the government raises income taxes then the labor. Progressive tax system. So the larger government gets and the more it raises taxes the more the economy slows down.

Find an answer to your question If the United States government lowers the income taxes on the wealthiest Americans while decreasing welfare payments to the po gooberthebear2116 gooberthebear2116. Taxes in the United States Governments pay for these services through revenue obtained by taxing three economic bases. According to Congresss official revenue-estimators at the Joint Committee on Taxation JCT the average effective US.

On the macro scale as government raises taxes most peoples net personal income decreases which means their disposable income also decreases. Thomas Eddlem noted in The New American that the federal governments responsibilities were limited to basic operational matters and did not include such modern expenses as social insurance programs welfare programs or. Since their disposable income decreases they spend less unless they want to just get deeper in debt which further decreases the gross income of those they buy goods and services from with their disposable income.

Individuals and corporations are directly taxable and estates and trusts may be taxable on. State governments use taxes on income and consumption while local governments rely almost entirely on taxing property and.

Return To Sanity Income Inequality Is Irrelevant In A Country Like America Income Tax Income Inequality

Government Revenue Taxes Are The Price We Pay For Government

Government Revenue Taxes Are The Price We Pay For Government

0 Comments